AI-based CV screening tools are now common in regulated sectors, but do these systems truly meet Singapore’s strict financial regulations? Our report uncovers significant issues regarding bias, explainability, and system reliability.

Conducted by AI and international standards experts at AIQURIS, this independent assessment focuses on CV screening systems used within Singapore’s financial services sector. It aligns with the Monetary Authority of Singapore (MAS) regulatory framework, specifically the MAS FEAT (Fairness, Ethics, Accountability, and Transparency) Principles for AI Risk Management. This thorough analysis provides a strong, multi-faceted approach to reduce systemic risks when deploying AI in highly regulated environments.

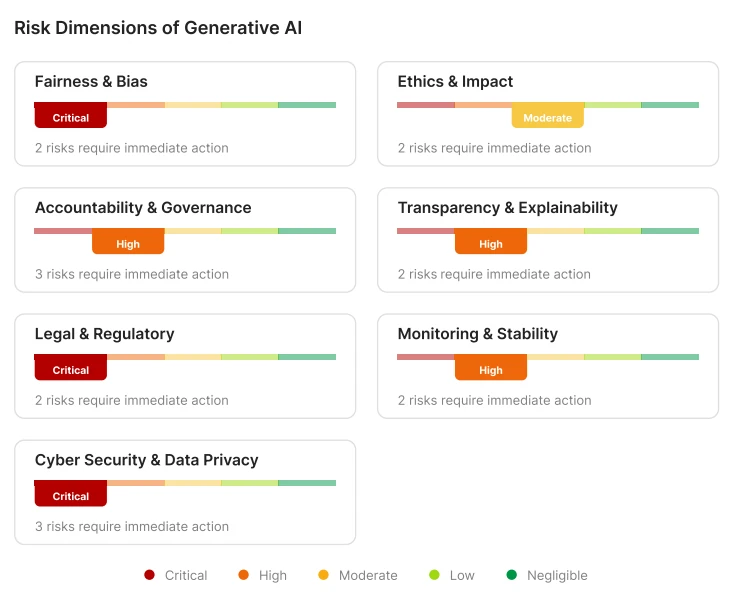

- Fairness & Bias: Potential for indirect discrimination due to training data imbalances

- Ethics & Impact: Lack of documented assessments on societal and human impacts of model use

- Accountability & Governance: Weak evidence of internal oversight or defined accountability structures

- Transparency & Explainability: Limited explainability of ranking outputs for affected individuals or reviewers

- Legal & Regulatory: Incomplete documentation of consent procedures and regulatory exposure

- Monitoring & Stability: No structured monitoring of model drift or performance decay

- Cyber Security & Data Privacy: Four high-severity gaps in encryption, access control, and data handling

Download the full report to pinpoint critical risks, strengthen your governance, and ensure your AI hiring systems meet all regulatory and operational expectations.